How much does it cost to file taxes?

Taxes are non-negotiable, but overpaying for them is. Businesses like yours shouldn’t settle for confusion or vague estimates when it comes to filing costs.

Every dollar that your business makes counts. Understanding how much it costs to file taxes gives you more control over your bottom line.

How much does it cost to file taxes? This guide provides a breakdown of average tax filing costs by form, outlines common additional charges, and explains key considerations when selecting a filing method.

Average tax filing costs for individuals and businesses

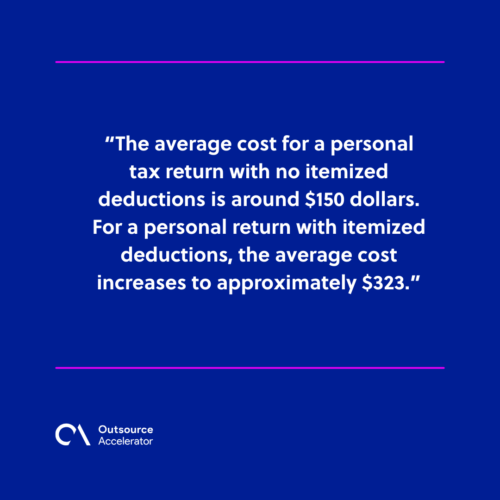

The average cost for a personal tax return with no itemized deductions is around $150 dollars. For a personal return with itemized deductions, the average cost increases to approximately $323.

Meanwhile, the cost to file taxes for a business varies by entity type and required forms.

Below are common averages:

- Schedule C (Sole Proprietorship): $192

- Form 1065 (Partnership): $733

- Form 1120 S (S Corporation): $903

- Form 1120 (C Corporation): $913

How much does it cost to file taxes?

How much does it cost to file taxes? That depends on your business structure, the complexity of your financials, and the filing method you choose.

Let’s look at average tax filing costs for businesses based on the form you need:

Taxes by form and service

| Tax form | Cost per form | Average hourly fee for filing |

| Form 940 (Federal Unemployment) | $78 | $111.95 |

| Form 940 (Schedule C, Self-Employment Tax) | $41 | $148.12 |

| Schedule C (Business) | $192 | $149.95 |

| Schedule E (Rental) | $145 | $149.52 |

| Schedule EIC (Earned Income Credit) | $65 | $146.70 |

| Form 1040 (not itemized) | $220 | $153.74 |

| Form 1040 (itemized) | $323 | $161.34 |

| Form 709 (Gift Tax) | $421 | $178.29 |

| Form 1041 (Fiduciary) | $576 | $172.66 |

| Form 1065 (Partnership) | $733 | $177.29 |

| Form 990 (Exempt Organization) | $735 | $171.48 |

| Form 1120-S (S Corporation) | $903 | $179.81 |

| Form 1120 (Corporation) | $913 | $181.57 |

| Form 706 (Estate) | $1,289 | $188.63 |

Extra charges when filing taxes

In addition to standard form fees and hourly rates, tax professionals may apply extra charges depending on the condition of your records and the type of support required.

Below are common additional costs that may affect how much it costs to file taxes for your business:

- Disorganized or incomplete records: An additional $166 may be charged if your documentation is not properly prepared.

- Filing extensions: Requesting an extension typically adds around $56.

- Previous year tax returns: Preparing non-current year returns may require a retainer of approximately $377.

- IRS audit preparation: If an audit is expected, a retainer of about $902 is often required.

- Expedited services: Requesting faster turnaround could result in an added fee of roughly $136.

Knowing these potential charges in advance helps your business prepare and avoid unexpected costs during tax season.

Factors that affect the cost of tax preparation

How much does it cost to file taxes? Several factors can impact how much it costs to file taxes for your business.

Understanding these can help you manage your tax preparation expenses more effectively.

- Business structure. The type of business entity you operate affects your filing costs. Sole proprietors usually pay less than partnerships or corporations due to fewer filing requirements.

- Revenue and expenses. Businesses with higher revenue and more expenses often have more transactions to report. This increases the time needed for preparation and can raise both form and hourly fees.

- Accounting method. Cash basis accounting is generally simpler and faster to prepare. Accrual basis accounting requires more detailed reporting, which can lead to higher preparation costs.

- State filing requirements. Operating in more than one state often leads to additional tax filing obligations. Each state has its own requirements, and meeting them may involve extra forms and documentation.

Strategic tax filing methods

Now that you know how much it costs to file taxes, the next step is choosing the most strategic filing method for your business.

In-house filing

Businesses with an internal finance team or a qualified bookkeeper may consider filing taxes internally. This method can reduce costs related to outsourcing, especially for businesses with simple tax needs.

However, this approach requires a solid understanding of tax laws, filing procedures, and compliance requirements. Errors in tax filing may result in penalties, delayed processing, or audit risks.

Certified tax professionals

Hiring a certified public accountant (CPA), enrolled agent, or tax attorney offers the highest level of support and expertise.

These professionals are trained to handle complex filings, regulatory changes, and multi-entity operations. They also assist with tax planning, audit preparation, and risk management.

This method is recommended for businesses with multiple partners, extensive revenue streams, foreign transactions, or specialized compliance needs.

Make tax filing stress-free in future tax seasons

Preparing for tax season should not begin a few weeks before the deadline. By maintaining accurate financial records throughout the year, your business can avoid unnecessary fees and reduce the time required for tax preparation.

Ask your tax preparer for a clear breakdown of costs, including any additional charges for late documentation or audit support.

So, how much does it cost to file taxes?

The short answer: It depends. But you’re now equipped with the long answer. You’ve seen average filing costs by form, understood common add-on charges, and explored what factors influence your fees.

Most importantly, you know the value of staying organized and proactive.

Evaluate your current system, talk with your finance team or CPA, and plan ahead. When you understand how much it costs to file taxes, you can start budgeting smarter.

Independent

Independent