The strong future of outsourcing: White Paper

Get the easy-read PDF version to your inbox now

A white paper, by Outsource Accelerator, exploring the trends, challenges, and initiatives in the outsourcing sector, and the unrecognized potential of the SME Sector as the potent success factor.

Part I. Overview

Introduction to outsourcing: a recent search for efficiency

The 1997 Asian financial crisis caused waves of economic anxiety and hardship that compelled many developed regions of the world to recalibrate their ways of doing business, push costs down, and diversify their operational portfolio as means to manage risks and mitigate costs. Outsourcing emerged at that time as a nascent key strategic thrust among companies, which allowed them to free up resources and redirect managerial focus to core competencies. Large firms began to look for providers that could take on the outsourcing of some of their operations, taking the following factors into consideration:

- High absorptive capacity for knowledge and technology

- An environment characterized by a resilient market and good governance

- Sufficient infrastructure to support advanced telephony and staffing needs

- An affinity to the customer and company culture

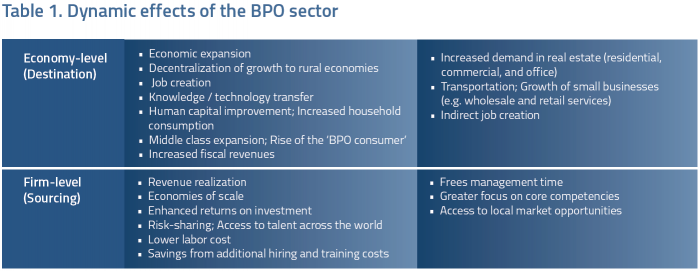

With such qualities that are desirable to businesses abroad, the Philippines thrummed with potential and quickly became a shining star within the dynamic Southeast Asian region. The BPO (Business Process Outsourcing) industry would later emerge as a sunrise industry for both the world’s large corporations and the Philippines.

The Philippines’ Department of Trade and Industry defined BPO as the “delegation of service-type business processed to a third-party service provider.” This later on evolved to “Information Technology and Business Process Management” or IT-BPM to better reflect the coverage and changing nature of its services.

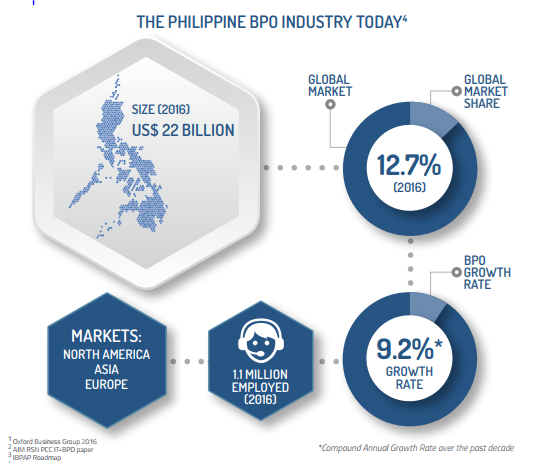

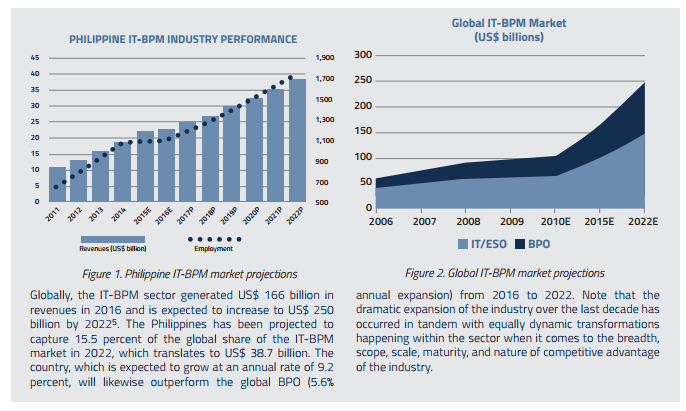

In just 10 years, the Philippines increased its world share of IT-BPM service provision from 4 percent in 2004 to 12.3 percent in 2014, or three times its portion of the pie. The Philippines’ BPO industry raked in USD 22 billion in 2015 and is today the second largest source of employment in the country. It services over 20 sectors across regional markets, most notably in North America, Asia, and Europe.

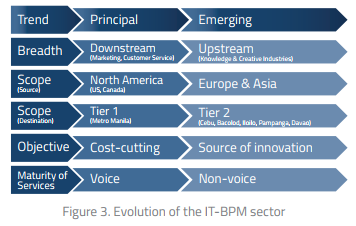

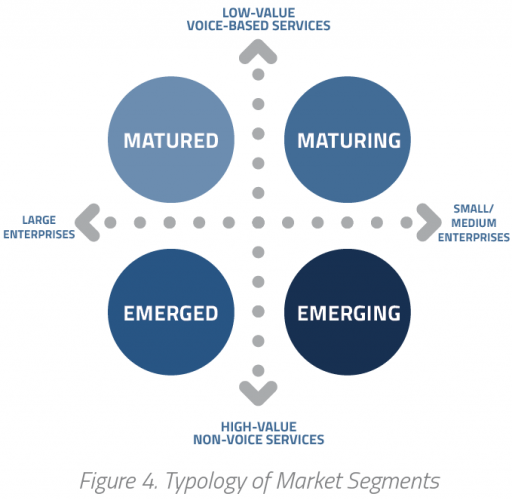

The table below illustrates the evolutionary development of the BPO sector service provision, as well as the emergence of regional cities such as Cebu, Bacolod, Iloilo, Pampanga, and Davao as new hubs of the global BPO market. The growth in these provincial areas puts the country in a good light, as a representation of the general state of Philippine development.

Despite the growing demand for non-voice services, voice services will remain a significant source of employment and growth in the Philippines in the coming years. In 2014, 6 out of 10 people employed in the sector belonged to the voice-sector. If this trend persists, there will be an estimated 1.1 million people employed in voice-based services in the Philippines by 2022.

A maturing sector?

The Philippine BPO sector is expected to slow down from the double-digit growth rates it enjoyed during the first phase of its expansion. Even as the Philippines builds its non-voice capabilities, which points to a “maturing” sector, it is critical that the policy stance indicated in the 2017 Investment Priority Plan and industry initiatives embodied in the new IBPAP roadmap maintain its momentum.

This roadmap has been endorsed and supported by IBPAP or the Information Technology and Business Process Association of the Philippines, which is the “enabling association” for the IT-BPM industry in the country, supported by various stakeholders, namely the government, chambers of commerce, and allied industries. IBPAP, keen on leveraging on the lessons and successes of previous roadmaps, hopes that the roadmap provides a new architecture for fully capitalizing on the potential benefits of the industry. This will fully capitalize on the potential benefits of this multi-billion dollar industry. It is clear that the BPO sector will remain a top contributor to nation building:

- It is projected to overtake OFW remittances as the primary source of foreign exchange earnings of the Philippines in 2017.

- It will remain the largest source of employment, with an estimated 1.8 million direct jobs by 2022.

- If we assume the current job multiplier of 2.5 jobs per BPO worker to hold true in 2022, it would create 4.5 million more indirect jobs .

- It will spur the growth of development in areas that will host IT-BPM companies (Makati City, Bonifacio Global City, etc.).

- It will increase household savings and consumption as seen in the emergence of a “new middle class” and the proliferation of late-night and 24-hour small businesses catering to the ”BPM consumer” and the BPM sector.

Part II. Democratization of outsourcing

Tapping into the business of small enterprises

The outsourcing sector is fast changing in both its breadth and depth of service provision. It is quickly upskilling in response to an increasing demand for broader services. This is an exciting development for the industry as it allows it to offer increasingly higher-value services, but it means that the industry has to keep pace with educational requirements to ensure that there is adequate supply of higher skilled roles.

However, when it comes to the main bulk of the outsourcing market, it is evident that the vast majority of jobs still remain within the original, more basic functions. When it comes to the global IT-BPM sourcing market for 2015, IT Services global sourcing accounted for nearly 60 percent of the world’s US$166 billion total. Another 40 percent came from BPO global sourcing services.

According to Frost & Sullivan Analysis from the iBPAP Roadmap 2022 show, demand for IT services will remain prevalent across all sectors while sub segments indicate an increasing Knowledge Process Outsourcing (KPO) demand followed by Finance and Accounting.

Key players who are keen on gaining a foothold on the sizable Business Processing Management (BPM) market understand that business-as-usual is not a viable strategy in a complex and dynamic environment.

Examples of such forward thinking businesses include Sharepoint and Tallyfy, which offer workflow and process automation platforms, as well as Zapier and Salesforce which are pioneering remote work solutions for businesses. With the attendant increase in competition through evolution and innovation, it is not only strategic but also practical to define new market segments within the broader IT-BPO segment. And as mainstream outsourcing services sign on the bigger players like multinational companies, the next impetus for growth in the sector appears to be smaller businesses.

A different story for SMEs

The same reports that tout the contributions of Small & Medium Sized Entities (SMEs) to the global economy also show that SMEs and startups are excluded from many of the critical support services that allow them to more efficiently grow their business. In comparison, the bigger, more established corporations has access to a broad array of services which enable to them to better optimise the efficiencies of their business.

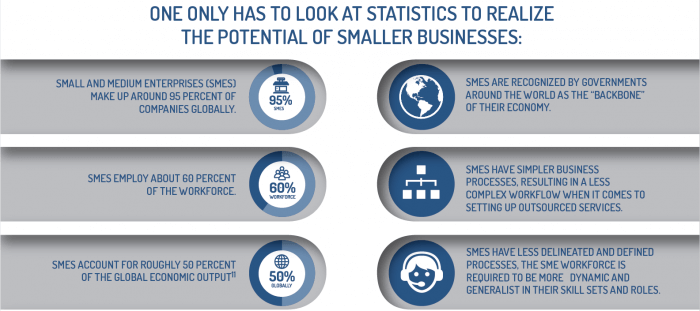

Despite SMEs constituting 95% of all businesses, employing 60% of the workforce – and being more fragile than their bigger counterparts, SMEs are excluded from many of the opportunities for cost savings, operational flexibility, access to skills and labor, and the ability to focus on the core business. And these are the areas that are often of most need to small companies, and those in the start-up phase.

Staff outsourcing can save companies as much as 60 percent on overhead costs, and 15 to 20 percent on outsourced data management and accounting. BPOs also provide the solution to common constraints that SMEs face such as attracting and retaining talent, and bearing the cost of additional office infrastructure and full-time employees.

Outsourcing part of their backend operations can allow SMEs to focus on sales or growing their core business and not bear the costs of inefficient sub-specialisation and role-multitasking at this critical phase of the business. Management research suggests that employees who are handling multiple tasks at once could yield a 40 percent drop in productivity, and costs the global economy an estimated $400 million annually.

Because of the mammoth collective size of the SME market, and the obvious operational and strategic advantage that BPOs can offer businesses – especially small ones – it is an obvious evolution for the SME and BPO markets to eventually migrate towards each other.

Defining SMEs

Currently, there is no standard definition for SMEs as countries who are at different stages of economic development also face a high degree of heterogeneity among firms. Regional groupings such as OECD define SMEs quite broadly as enterprises which “are non-subsidiary, independent firms which employ fewer than a given number of employees”. The frequent upper limit in the European Union is 250 employees, while the workforce could consist of only 100 people in the Asia Pacific Region.

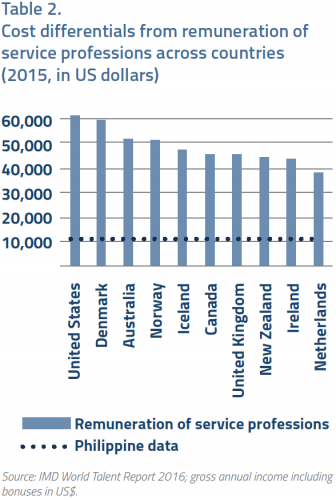

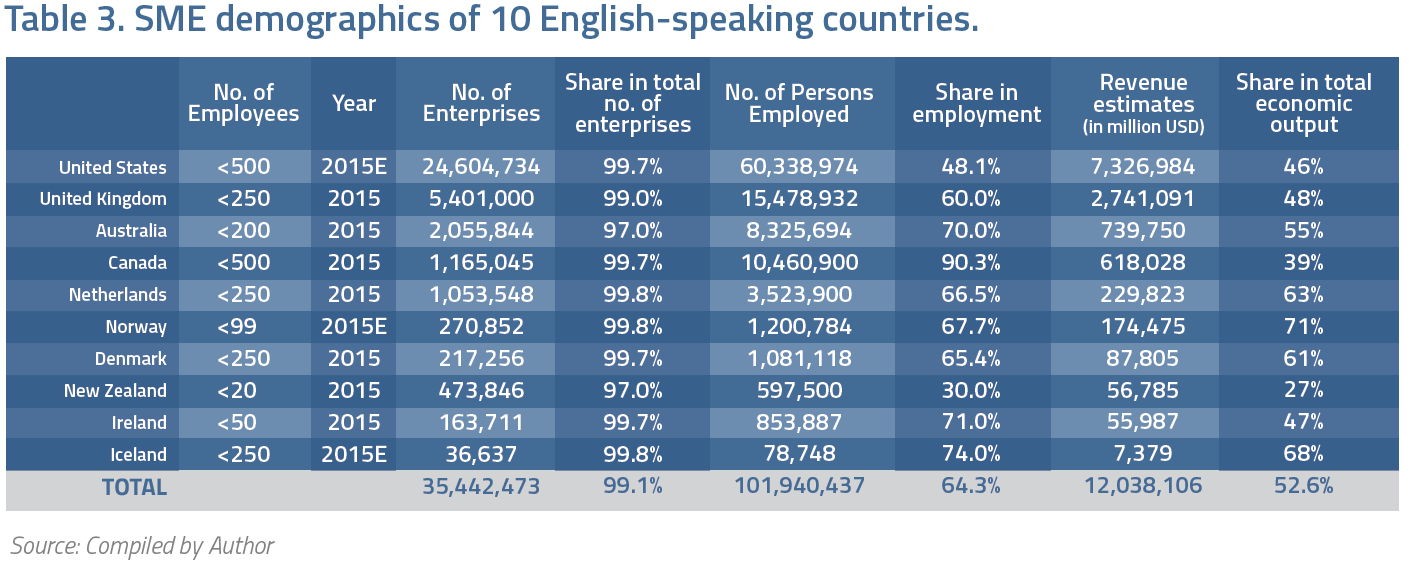

For the purposes of this paper, we maintain country-level definitions of SMEs for 10 high-cost English speaking economies (see Table 3). These advanced economies have the greatest potential in cost-savings from outsourcing given the relatively high labor costs within their respective countries. In addition, the English-speaking population of these countries makes it easier to do offshore activities because of the low cost of language barriers.

Declining trends

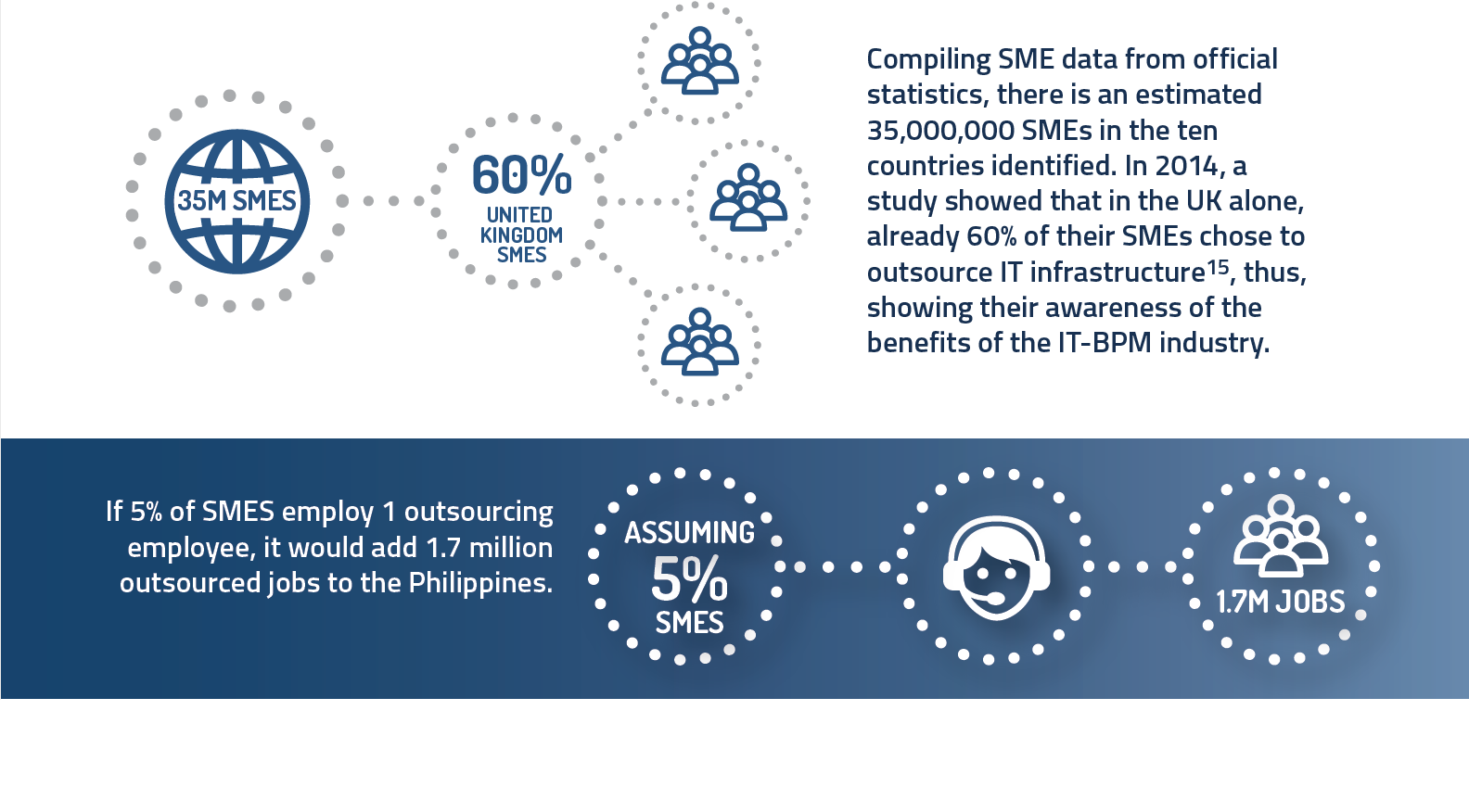

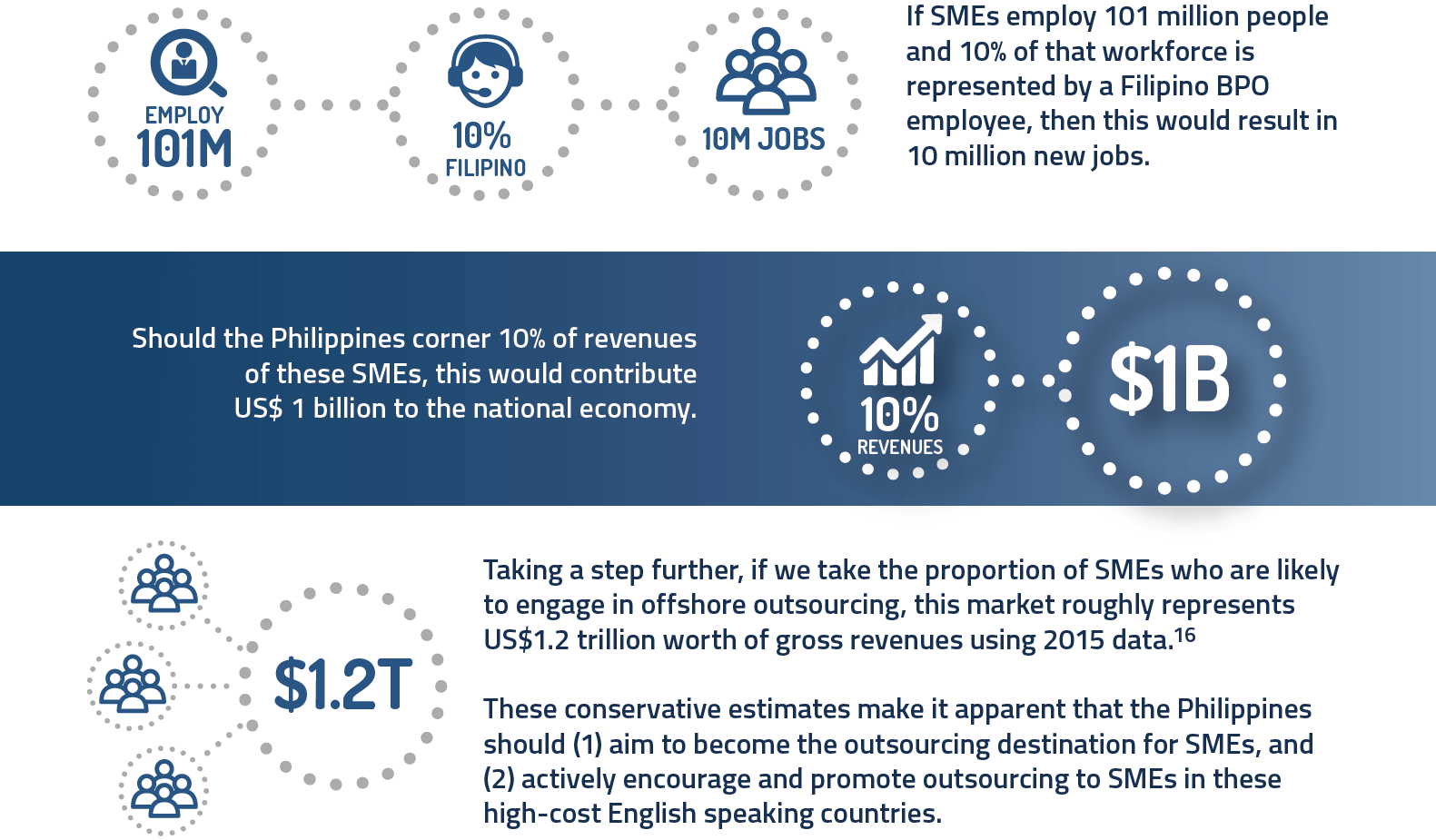

Observers of the BPO sector have seen a decline in the growth of large scale outsourcing clients. They see Artificial Intelligence (AI) entering the space, putting downward pressure on the industry’s basic roles. They see that the sector has little interest in the SME market because it is used to catering to the single clients that contract thousands of staff each. They conclude that the future of BPO, which is traditionally linked to large multinationals, may not seem as robust as in the previous years of the industry – and may now be a sunset industry. But, this simple exercise illustrates a massively untapped market in SMEs – a market which can produce at least one million more jobs for the Philippines.

The world’s small businesses are expected to be the next sources of innovation and growth, and a few may become the next big corporate mammoths of the future. In the US for instance, while small businesses accounted for 8 percent of patents granted, they make up 24 percent of patents in top 100 emerging technological hotspots– from agrigenetics to telecommunications and semiconductors.

In Canada, whether in business processes or their respective products. In the UK, SMEs are expected to grow by 11 percent by 2020, or contribute as much as GBP£ 196 billion.27 Likely sectors that dominate the SME environment are from the professional services and, increasingly, from the wholesale and retail sector. Australian data on SMEs also point to double-digit growth rates in recent years and are expected to grow even as middle-sized businesses transition to large enterprises.28

High value demand

What are the type of jobs SMEs are likely to outsource? Ironically, SME’s might, on a whole, be less sophisticated than large multinationals. But within an outsourcing setting, it is the SMEs that generally seek more highly skilled roles for fulfilment. For example, the large multinationals might seek to outsource 5,000 basic tele-support roles; whereas an SME might need one web designer, one digital marketing manager, and five sales executives.

Small businesses by their nature do not yet have the advantage of scale and specialisation. Their small size and rapid pivots mean that their limited number of staff need to be agile generalists. This requirement has previously not aligned well with the service offerings of BPOs, which specialise in large-scale highly standardised repetitive tasks.

Using the example above, it is far more complex for a BPO to manage seven staff covering three roles than it is to provide 5,000 people fulfilling one function. But as the industry matures, the BPOs are becoming more nimble and increasingly able to provide a broader range of more flexible services. They are realizing that despite seven staff being less impressive than 5,000; the seven staff are more highly skilled (value-add offering), and there are far more potential SME clients in aggregate than there are multinationals.

Outsourcing is an obvious, but until now overlooked, performance-enhancing opportunity for small and nascent companies. Companies in the startup stage can benefit from freeing up resources from tasks that are more standardized in nature and/or highly administrative. This is true as early-stage businesses focus on low-tech but skill-intensive tasks mostly for executive support and process automation. As the business matures, however, the focus shifts towards creating more value through analytics and the application of technologies to achieve business impact and drive down costs.

The new economy

If we take into account the “gig economy,” we get a better picture of the kind of freelance work Filipinos are already rendering. The table below shows the skill areas employed by websites that specialize in online freelance services such as UpWork (formerly Elance & oDesk) and Freelancer. In 2015, UpWork registered 1.4 million Filipinos onto its platform. The company estimates revenues amounting to USD 200 million from its operations in the Philippines alone. UpWork makes more than USD 900 million a year, making it the biggest company of its kind in the world.

It is now time to ask if the Philippines is ready to take best advantage of the expanding international SME market, and mature in-step with the burgeoning “gig economy”.

Growing by 16 percent from the previous year, the Philippine BPO sector generated at least USD 25 billion in revenues in 2016, which represents approximately 8 percent of the country’s GDP. While the Philippines still lags behind the sheer scale of India’s outsourcing, the sector is still expected to grow and even overtake overseas remittances and become the major source of foreign exchange earnings. At current estimates, the country employs 1.4 million full-time employees. This shows that the Philippine BPO sector is not only significant in terms of its domestic benefits to the economy but also in the international business ecosystem as an established world leader in outsourcing services.

In addition to this, the Philippines can count on its young population, with the country’s average age being an admirable 23 years old. This young, growing, and increasingly skilled workforce is expected to sustain the country’s impressive economic growth in the upcoming years. The youth nowadays is also more open to technology, using different forms of learning to supplement the traditional classroom setup. With this is the emergence and widespread adoption of Massive Open Online Courses (MOOCs), and other free, or very low cost, platforms utilizing this development such as YouTube channels, Udemy, and Khan Academy.

However, major shifts in the industry are to be expected, especially in a sector that is both closely connected to technological development, and quickly maturing. A potential slowdown in growth – not just in terms of revenues but also in terms of the number of people it employs – will pose new challenges for the industry.

Questions on the future of work generally, and the ways that we hire and outsource, will be more closely considered as we move towards the so-called “fourth industrial revolution” characterized by breakthroughs in technological fields such as in artificial intelligence, robotics, internet of things, autonomous vehicles, three-dimensional printing, nanotechnology, biotechnology, materials science, energy storage, and quantum computing.

This vast and sweeping disruption will affect all industries, across all countries and will have a monumental impact on employment traditions. The Philippines will have to ensure that it stays relevant to these changing skill and role requirements, or else it could that the traditional outsourcing provision becomes obsolete. The Philippines however – with its young, dynamic, well educated, English-speaking workforce – is well placed to stay abreast of these developments. This fast changing environment could even play to the advantage of the country.

While superior technologies create abundant opportunities for efficiency, governments worldwide are now looking to technology-driven yet human-centric approaches to economic development.

A challenging environment

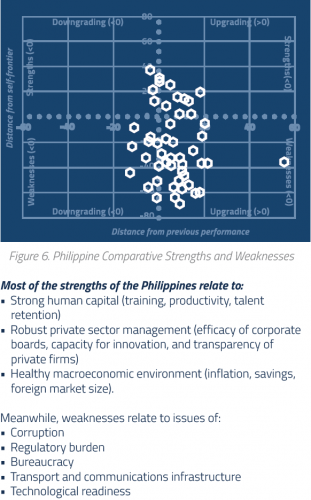

When we look at the Global Competitiveness Index (GCI), indicators reveal interesting patterns for the Philippines. In Figure 6, we compare the rankings of the Philippines for each GCI indicator against its overall rank (i.e. the “frontier”). Those that perform above this country-rank are the relative strengths of the country, while those that perform below the rank are deemed weaknesses. We then compare these same indicators from the previous year’s performance of the Philippines to see which areas are “upgrading” or ”downgrading.” Plotting indicators from both years reveals an interesting pattern (Fig. 6).

However, it is interesting to note that while the Philippines ranked quite poorly in some areas, many have seen a marked improvement, most notably in ICT-related indicators. This shows a drive by public policy makers and industry players to improve the business environment and competitiveness of the Philippines. The SWOC matrix below aims to summarize these points.

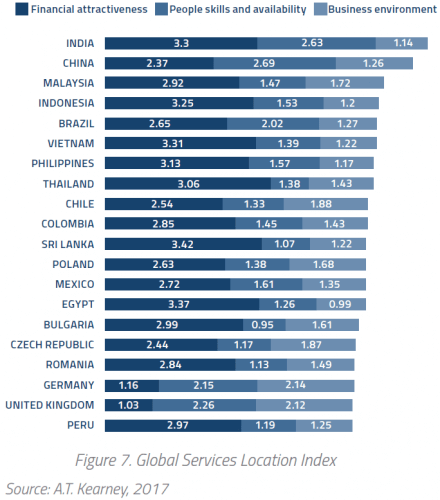

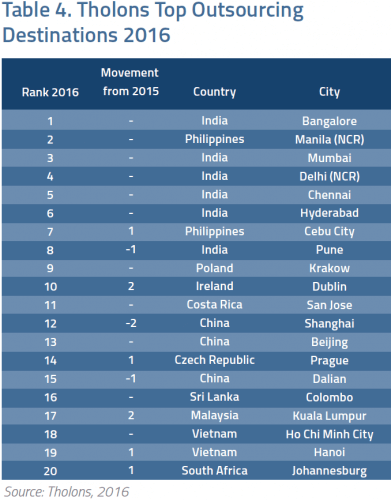

A survey of global players

The Philippines enjoys its position as one of the most attractive destinations for offshore services. A.T. Kearney (country-wise) and Tholons (city-level) rankings show that the country and its capital continues to belong to the top 10 countries and cities for outsourcing. While the Philippines ranks seventh worldwide, it still fared better than Thailand, Brazil, and China in terms of financial attractiveness based on the 2017 Global Services Location Index. It also bested its ASEAN peers in terms of people skills and availability. The Philippine business environment outperformed all others as the top location for outsourcing.

Behind the high rankings, however, is the pressure to remain in lock-step with the rapidly changing nature of the outsourcing business. India, for example, a global leader in voice services, is now moving to provide more non-voice support and services. China and Mexico, usually identified as “alternative BPO destinations,” are now seen as legitimate rivals of top-tier cities as they mature in terms of capabilities and service portfolio. China, on the other hand, is relying on volume to significantly increase its share in global IT & BPO market – in contrast to India’s strategy of increasing profitability per employee. Other emerging competitors include Thailand, Malaysia, and Indonesia. A brief survey of these regional players is summarized in the table on the right.

There are two factors that make the global leaders in IT-BPM attractive to clients.

- Scale, which translates to savings from a relatively large domestic market and labor force, i.e. “quantity.”

2. Talent, which is also the domestic capability to meet demands of outsourcing firms with the least amount of friction such as language barriers and business policies, i.e. “quality.”

While both India and Philippines share these factors, India appears to have the upper hand when it comes to the number of people who speak English, which is second only to the US; and the quality of English proficiency. In 2015, India employed about twice the number of outsourced workers as that of the Philippines. To remain competitive, both countries need to focus on innovation and higher-value growth by embracing advances in this field.

As for ”alternative locations” using the framework, China has great potential when it comes to ”scale” but is hobbled by their language and communication skills. Mexico, on the other hand, benefits from its affinity with and proximity to the US market and boasts exemplary multilingual skills. However, it is constrained from growing in scale relative to India, but remains a credible rival to the Philippines. The main strategic objective for second-tier locations is to enhance credibility in the world market by increasing its volume and enhancing its productivity.

Emerging competitors, on the other hand, are characterized by unreliable levels of domestic capabilities. They need to resolve major business environment issues such as inefficiencies in government bureaucracies and inadequate supply of infrastructure in order to attract clients. A natural growth strategy for these third-tier locations is to design effective policies directed at improving the competitiveness of its firms, learning from global leaders, and reducing barriers to industrial development.

Supporting initiatives and bodies

The Philippines enjoys major improvements in its business environment compared to previous years. Such improvements are linked to the roles and initiatives played by the BPO industry, the Philippine government, and the academe, in supporting the country’s outsourcing sector. In less than a decade, the Philippines moved up 37 places when it comes to the Ease of Doing Business. From 138 in 2010, the Philippines ranked 99 in 2016. There is obviously still a long way to go to bring the business environment to ‘Western standards’, but there is evidence of strong inertia and global support from within the associated outsourcing and government bodies.

The key to enhancing ease of business and confidence in the local BPO sector has been the role of industry associations. Indeed, on its third iteration, the umbrella organization IBPAP (Information Technology and Business Process Association of the Philippines) asserted its enabling role in directing multi-stakeholder effort towards capturing the USD 39 billion opportunity. When the group released “Accelerate Roadmap 2022” in 2016, it hoped to propel the entire sector on a six-year growth and sustainability track through 21 high-impact programs. The programs hope to:

- Increase the Philippines share of the global IT-BPM (BPO) market to 15.5 percent

- Enhance mid-high skilled jobs by 73 percent

- Hire 16 percent more post-graduates

- Grow facilities outside Metro Manila by as much as 11 percent

- Diversify its services portfolio to 42 percent

- Contribute 1 out of 1 jobs to national job creation (Villafania, 2017)

As one of the country’s main revenue generators, the outsourcing industry has looked to the government for help. In 2013, BPOs were named a Preferred Activity by the Board of Investments (BOI) – allowing it to enjoy local fiscal and non-fiscal incentives such as tax holidays. The government also set up special economic zones (PEZA) which allowed BPOs to enjoy income tax holidays, tax exemptions, and permanent resident status to foreign investors and family members, among others.

Other initiatives that are set to benefit the BPO industry include the establishment of the Department of Information and Communications Technology (DICT), the Data Privacy Act, Cybercrime Prevention Act, and the prospect of a national broadband network.

In addition to moves that would improve the reliability of infrastructure for a service-based economy, the quality and depth of talent also needs to be addressed. IBPAP provided some alarming figures in this regard – only 5 to 8 percent of applicants are actually hired by the county’s BPO companies. This implies that there is a large number of applicants whose qualifications do not match industry requirements. To address this concern, industry organizations are working with the Department of Education to craft policies aimed at upgrading human capital, such as the recently launched K-12 program, dual training approaches, and technical-vocational courses spearheaded by TESDA.

While the IBPAP and the other industry bodies have been very effective in championing the development of Philippine outsourcing, they demonstrate a blind spot for SME outsourcing. Historically, these bodies have focused only on the large-player end of the sector, and have left the SME space to fend for itself. There is an urgent need for the SME sector— which caters to the more disaggregated, faster-changing, more technological and future-proofed roles—to be better represented, supported, and promoted to the world.

Part III. Outsource Accelerator

The above initiatives, which span many sectors and agencies, show how serious the Philippines is in building a strong successful future for outsourcing.

However, while these activities undoubtedly benefit the BPO sector, key aspects of the industry are lacking critical strategic assistance. The lion’s share of current activities focus mainly on (i) internally facing initiatives – i.e. industry bodies looking within the industry – and (ii) as mentioned, the mammoth corporate/enterprise clients.

These activities have historically served the sector well, but times have changed, and the market is evolving. With such fast-paced change underfoot, it’s critical that the sector stays relevant and within the growth curve, otherwise it will be left behind. This risk is already more than conjecture, as the IBPAP and government bodies are already labelling today’s outsourcing as a stagnating sunset industry.

The outsourcing industry is possibly the biggest and best opportunity for the Philippines to develop its economy, and pull itself from its historic poverty and into a new affluent “gig-economy”. The outsourcing opportunity is far from dead, and just needs repositioning so that it becomes relevant once again.

Redefining outsourcing and employment

Eventually, outsourcing will not be called ‘outsourcing’. Eventually, it will simply be called ‘employment’. As technology increasingly makes the world flatter and smaller, the world will soon truly be seen as one market place. This will happen in all aspects of life and commerce, but most dramatically within the employment sector.

Once technology creates a seamless interface between employees sitting across the globe, it will not matter which city or country they’re based. Prior to the internet, people would hire staff based on the geographic location (i.e. their town) in which they were sitting. Moving forward, as the friction of ‘remote working’ is reduced, employers will be selecting people based on a truer meritocracy – their ability to get a job done, for a certain price – instead of geography.

As technology removes these borders, as commerce becomes more information based, and as BPOs service providers become more flexible, outsourcing simply will become the new norm for employment. It will eventually become ubiquitous. As this evolution happens, the Philippines is best placed to capitalize from this.

The Philippines is clearly one of the best, most experienced and most qualified outsourcing destinations in the world, and so with effective promotion, it can become the obvious default choice for those potential clients beginning their outsourcing journey. The Philippines is also cheap—which is a great boon— and shall remain so for some time, and has a big pipeline of well qualified university graduates, and a young, culturally-aligned workforce.

Instead of seeing outsourcing as a dwindling fringe function, outsourcing will develop a closer uptake and relationship to standard employment. Yes, standard employment is under-threat (from AI and automation etc.), and will face some dramatic disruption over the coming decades, but as long as there is employment of some kind, there will be increasing amounts of outsourcing alongside.

When looking at the numbers, employment is obviously a far bigger ‘pie’, than the outsourcing pie. We only need to look at the earlier figures to affirm this: (i) As a world leader of outsourcing, the Philippines employs about 1.1million people in the sector, India employs about 3 million. In comparison (ii) SME’s in the Western World through general employment, have over 100 million people.

Consumer-facing solutions

For the outsourcing sector to become more relevant, it needs to focus on the high-growth, and as yet unsaturated, SME market. Those businesses in the SME market are inclined to be early adopters, and can more quickly evolve alongside new technologies and trends. As already highlighted, the SME market collectively plays a dominant role in world commerce and represents over 60% of total employment. Outsourcing needs to position itself, as a concept, more closely with ‘regular employment’. This would exponentially increase the potential size of the outsourcing pie, and would remove a lot of the esoteric ambiguity of ‘what outsourcing is’ for the SME consumers.

Philippine outsourcing needs to be promoted to the world. The messaging needs to be simple, and the interface to learn and engage with outsourcing accessible and more consumer-centric.

Currently, the outsourcing industry bodies are largely internally focused, or focused on the big players. Instead, the industry needs a platform which promotes outsourcing to the world, and specifically to the vast SME (B2B) consumer base.

For this to happen, there needs to be an SME/consumer-focused platform which outsourcing is made relevant to them, and speaking in their language. Outsourcing needs to be demystified, and promoted to the world.

SMEs first need to be made aware that outsourcing is actually an option, then they need to get comfortable and then educated on the basic concepts. Access and integration needs to be made easier, so that the hurdles for ‘giving it a go’ are reduced.

There are platforms now for almost every industry under the sun (consumer and B2B), yet there is nothing in the USD 100 million+++ outsourcing space. In the same manner e-commerce revolutionized the retail industry by providing a unified platform for buyers and sellers, there is an opportunity for such a platform to revolutionize the outsourcing industry.

The value proposition

In the context of where the BPO industry is and where it hopes to be in the future, Outsource Accelerator has come into being. Outsource Accelerator (OA) is rapidly becoming the world’s foremost authority on outsourcing to the Philippines. Particularly focusing on SMEs, Outsource Accelerator provides abundant free information promoting outsourcing and business in the Philippines. Their services include:

- An industry Newshub, blog articles, and ebooks

- A BPO directory

- Thrice-weekly podcasts

- Industry blueprints and guides

- Outsourcing advice and insights

- Community engagement via social media sites like Facebook

- Relevant knowledge and advisory services

Despite 95% free invaluable information, Outsource Accelerator is a for-profit company, with a mission to sustainably support and promote outsourcing to the world. Its monetization strategy is to offer a small range of consulting services and packages, which help educate prospective outsourcing clients and assist them with integrating outsourcing into their business. All services are packaged to offer fantastic value while remaining affordable to all SMEs and individuals across the global market. The nature of OA’s products and services also makes them highly scalable to reproduce and disseminate.

Outsource Accelerator is creating a comprehensive and centralized platform for outsourcing education and promotion. As a one-stop shop, Outsource Accelerator aims to simplify the concept of outsourcing, especially to new candidates within the SME space.

Outsource Accelerator, through its platform, will demystify outsourcing and answer many of the questions asked by potential entrants into the world of outsourcing. It will also provide materials and guidelines related to the Philippine BPO sector. With the promise of efficiency and high quality output at a lower cost, the Philippines’ outsourcing sector is at a great advantage in offering its services to the global market. Outsource Accelerator will make it easier to match local and international client needs with the right BPO firm.

Other functional components

Branding the outsourcing sector

As the Philippines continues to strengthen its reputation as one of the premier BPO providers in the world and increasingly becomes a significant part of the global value chain, Outsource Accelerator believes that effective centralized branding and promotion of the sector is key to ensuring its continued success.

Just as the Department of Tourism tagline “It’s more fun in the Philippines” has become iconic to the Philippines, the local BPO sector must also rally behind a slogan that will distinguish it from other countries with BPO services.

The slogan must immediately communicate how the BPO industry is the best in the world— offering services that are world class and staffed by highly efficient employees known for their excellent outputs.

Outsource Accelerator plans to leverage its platform to promote the country’s BPO sector using a similar marketing strategy, which aims to increase familiarity and confidence in outsourcing generally, and Philippine outsourcing more specifically. Outsource Accelerator propose that the Philippines is promoted as the ‘Swiss banking of outsourcing’.

Knowledge media. Although the BPO industry has evolved into a big business over the years, only a few are familiar with its workings. For many business owners in the West, outsourcing is simply an ‘unknown entity’, or worse, it might be misconceived as an unethical “IT sweatshop”. Within the Philippines, the potential of outsourcing careers can also be undervalued and seen simply as a stepping-stone for fresh graduates to make their hay before they find “better” jobs or pursue a career elsewhere.

It is clear that more promotion and effective marketing is required. SMEs are largely unaware of the potential of outsourcing and how it can transform their business. This is a key strategy of OA: to increase the awareness and comfort levels with outsourcing amongst foreign SMEs. Outsource Accelerator aims for a strategic use of media through high-value content generation to promote the industry to the world.

Network of outsourcing brokers

BPO brokers are independent individuals who engage potential customers in their local market using their local networks. Outsource Accelerator acknowledges the potential of this decentralized approach and aims to augment the potential that they may bring to the BPO sector. With this, Outsource Accelerator will start to build a network of locally based BPO brokers.

Upon acquiring the necessary knowledge and assessment tools, localized brokers are then able to go out and develop business, for the Philippines outsourcing sector, amongst their own community. This effectively creates a network of self-employed brokers who provide valuable support, promotion, and leads for the Philippine outsourcing sector.

A sense of community

Although second only to the OFWs in terms of economic clout, the BPO industry has none of the sense of community OFWs have forged globally.

OFWs remain connected to their families back home while having scores of activities, gatherings, and other social events that bring them closer to fellow Filipinos abroad.

BPO employees do not have that kind of esprit de corps. They do not have established organizations that allow employees to network among themselves. Outsource Accelerator recognizes the need for such an initiative. Thus, it proposes the “Outsource, Offshore, and Remote Workers” or OORW community as a driver of growth to the middle class and highly skilled BPO workers of the Philippines.

BPO academy

The proliferation of so-called “corporate universities,” such as those of General Electric, McDonalds, Pixar, Deloitte, General Motors and Apple, among others, serves to effectively address upskilling needs within these corporations. The popularity of corporate universities rose as a result of its ability to apply a combination of research-based training within a practical business set-up.

Outsource Accelerator proposes the founding of its own BPO Academy to bridge theoretical knowledge and evolving industry practices. This will enable future BPO workers to gain more access to relevant technical training and education, and perhaps to finally establish BPOs as a sector in which to forge a viable career.

Key takeaways

The growth and trajectory of the global BPO market augurs well for the Philippine economy, given that the sector will likely become the primary driver for economic growth and employment. The Philippines was able to maintain its global competitiveness in the BPO industry, keeping its rank as second in the world and besting other giants such as China and Malaysia in certain aspects. However, changes in technology will require the Philippines to adapt and seek new market segments.

This paper recognizes that SMEs located in English-speaking markets offer a potential that has yet to fully reveal itself, and one that the industry is slow on developing. It also acknowledges the historical difficulty of SMEs to access offshore outsourcing services. Thus, removing the friction and better linking SMEs to Philippine BPO providers will enable the country to better capitalize on and fully realize the potential of this new economic gold rush, as well as equally mitigate the brutal impact of an otherwise maturing/declining BPO industry.

Moving forward, the Philippines should build on its achievements to usher in a high-growth trajectory for a critical sector of Philippine competitiveness in a new globalized setting.

Independent

Independent